Supplement Distribution: Understanding Key Distribution Channels

Contents Overview

Supplement Regulations: Navigating Compliance

The importance of understanding supplement regulations in 2025 to avoid legal pitfalls may not be as complicated as one might think.

Dietary supplements are categorized as food products, not pharmaceuticals or medicines, and are therefore subject to different regulations. Unlike pharmaceuticals, which require licenses and undergo stringent approval processes, dietary supplements are regulated by food safety regulations. This means that dietary supplement manufacturers do not need certifications like Current Good Manufacturing Practice (CGMP) certification. Instead, to ensure their products are safe, high-quality, and accurately labeled, manufacturers need to obtain a food production license. Although supplements don't go through the same approval process as pharmaceuticals, manufacturers must still follow strict guidelines to maintain product integrity and protect consumers. Regulations can vary significantly between countries. Some countries still require quality certifications such as ISO, HACCP, and halal labels. Additionally, some countries classify supplements as pharmaceuticals if they contain high dosages of certain minerals or nutrients.

Supplement Trends in 2025: Evolving Consumer Demand and Distribution Shifts

The global dietary supplement market is set for significant expansion, projected to reach $166.58 billion between 2025 and 2032. This growth is driven by heightened consumer awareness of physical and mental well-being, accelerated by the post-COVID health-conscious mindset. Supplements are no longer viewed as occasional solutions but as essential daily health investments for both younger consumers and aging populations.

Popular supplement categories shaping the market include:- Essential nutrients - B12, Vitamin D, and bone support formulas.

- Mental wellness - Ashwagandha, magnesium, and adaptogens for stress and sleep.

- Gut health - Probiotics and digestive enzymes.

- Sports nutrition - Protein powders, amino acids, and performance enhancers.

- E-commerce and DTC brands are booming due to personalized subscription services and AI-driven recommendations.

- Retail pharmacies continue to play a central role, particularly in regulated markets where healthcare professionals influence supplement choices.

- Health food stores and supermarkets remain key players, requiring suppliers to cater to both high-volume mass-market sales and niche premium products.

- Fitness centers and gyms are becoming vital awareness points, even if purchases happen later online or in stores.

This evolving landscape requires a multi-channel strategy, balancing traditional B2B distribution with emerging digital sales channels. The ability to adapt to different retail environments and consumer purchasing behaviors will determine success in this growing industry.

Distribution Channels: Where to Sell Supplements

- Regulated Markets: These countries impose strict regulations on supplement sales, often requiring government approvals, clinical studies, or specific labeling requirements. Sales channels are usually limited to pharmacies and medical institutions, where trained professionals can guide consumers.

- Unregulated or Semi-Regulated Markets: These countries have fewer restrictions, allowing supplements to be sold through various retail channels, including supermarkets, health stores, gyms, and online marketplaces. Consumers rely more on marketing, brand reputation, and word-of-mouth rather than professional recommendations.

Pharmacies

Pros:

- High consumer trust in pharmacists and pharmacies.

- Easier regulatory compliance when working within pharmacy networks.

- Strong potential for brand loyalty and repeat purchases.

- Complex and time-consuming regulatory approval processes.

- Limited flexibility in pricing and promotional strategies.

- Dependence on pharmacy chain purchasing decisions.

Health Food Stores

Pros:

- Knowledgeable staff, loyal customer base, strong brand positioning.

- Ability to sell high-margin, specialty products.

- Higher competition, limited customer reach compared to mass retail.

- Smaller sales volumes compared to supermarkets or online marketplaces.

Supermarkets & Mass Retailers

Pros:

- High foot traffic, broad audience, potential for private-label partnerships.

- Strong visibility and impulse buying potential.

- Lower margins, less consumer education on specialized products.

- Competitive pricing pressures from store brands and mass-market alternatives.

Gyms & Fitness Centers

Pros:

- Targeted audience, direct engagement with fitness-conscious consumers.

- Opportunity for bundled promotions and sampling campaigns.

- Lower volume of sales compared to other retail channels.

- Reliance on partnerships with gym owners and trainers.

E-Commerce & Direct-to-Consumer (DTC) Sales

While offline retail remains dominant, digital sales are surging: The final consumer would rather still buy their supplements from a store or pharmacy than go online, although the global online marketplace is not to be ignored, especially for specific dietary supplements where the final user has a particular supplement that they desire.

- Brand websites & DTC models - Offering subscriptions and personalized supplement plans. Pros: Higher profit margins, direct customer relationships, subscription-based revenue. Cons: Requires strong marketing investment, logistics, and customer support.

- Online marketplaces (Amazon, AliExpress, iHerb, etc.) - Expanding global reach. Pros: High visibility, existing customer base, streamlined logistics. Cons: High competition, platform fees, limited control over branding.

- Local Marketplace (Allegro, Zalora, etc.) - Serving regional online consumers. Pros: Access to country-specific buyers, reduced competition compared to global platforms. Cons: Lower brand recognition, platform restrictions, varying marketplace rules.

- Social commerce (TikTok Shop, Instagram, YouTube) - Leveraging influencer-driven recommendations. Pros: High engagement, trust-driven sales, viral marketing potential. Cons: Short product lifespan per trend, dependence on influencer partnerships.

The most successful supplement brands in 2025 and beyond will adopt a multi-channel distribution approach, ensuring a strong presence in both traditional retail and digital platforms to maximize consumer reach and engagement.

The dietary supplement market is growing rapidly, creating opportunities for businesses that stay ahead of trends and regulations. In 2025, demand for personalized supplements and products supporting physical and mental well-being will rise.

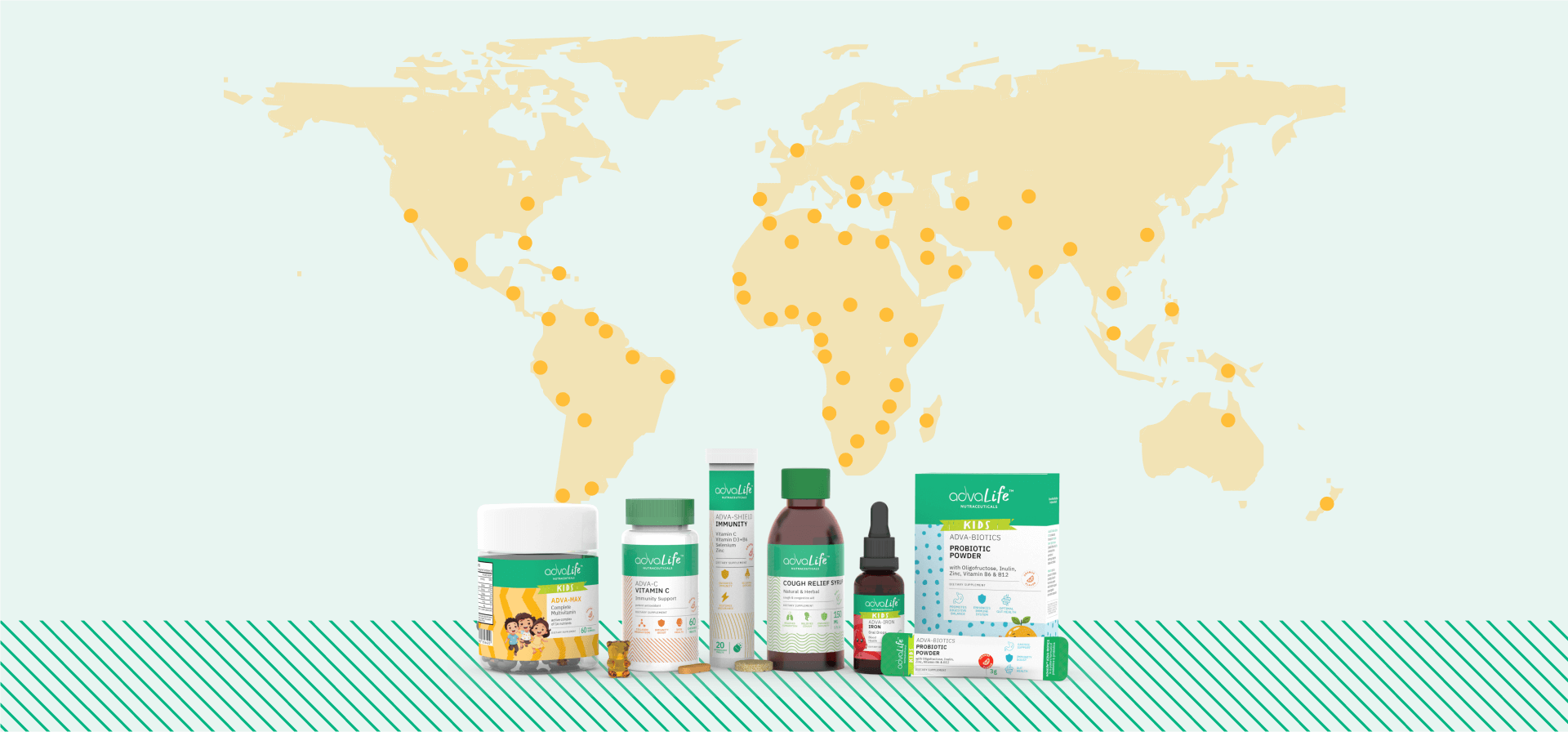

AdvaLife™, an internationally recognized brand, offers over 150 high-quality, affordable products in 40+ countries. With pharmaceutical expertise, we provide customizable formulations that give distributors a competitive edge.

Choosing the right distribution channels is key. A strong B2B strategy-through online platforms, pharmacies, health food stores, or gyms ensures market success. AdvaLife™ supports distributors with a reliable supply chain, regulatory expertise, and marketing and logistics assistance.

Partnering with AdvaLife™ grants access to innovative products aligned with global trends. Whether launching or expanding a portfolio, our expertise and flexibility help businesses thrive in the competitive nutraceutical market.

References: FDA 2024 "Dietary Supplements" FDA 2025 "Current Good Manufacturing Practice (CGMP) Regulations" ISO 2025 "About ISO" HACCP 2025 "HACCP Certification and GMP Audits" HFC-USA 2025 "About HFC-USA" MR 2024 "Dietary Supplements Market to Reach $166.58 Billion by 2032"

Don't want to miss the next AdvaCare article?

Recommended Content

Veterinary Medicines Registration in Indonesia

White Label vs Private Label vs Distributing: What’s Best for Supplement Businesses?

Supplement Manufacturing Process